According to DCD, AI data centers are fundamentally changing how real estate deals get structured, moving from simple leasing arrangements to complex multidisciplinary negotiations. Companies like Google, AWS, Microsoft, and CoreWeave are forming new partnerships with investors, developers, and local stakeholders to handle unprecedented power demands of 50-100kW per rack versus just 5-10kW a decade ago. These deals now involve detailed power delivery SLAs with indexed pricing, hedging, and termination clauses if megawatt commitments aren’t met. Legal teams must navigate environmental permitting, energy sourcing, tax incentives, and community relations simultaneously. The complexity has created a sophistication gap where large hyperscalers can demand custom terms while smaller operators struggle with standardized agreements.

Power becomes the real estate

Here’s the thing: we’re not really talking about physical space anymore. The actual real estate is almost secondary to the power infrastructure. When you’re dealing with racks that consume as much electricity as small neighborhoods used to, the entire negotiation shifts. It’s not about square footage – it’s about megawatts, cooling capacity, and grid reliability.

And that’s why we’re seeing these massive tech companies getting directly involved in energy procurement. They’re not just buying space; they’re structuring deals around battery energy storage systems, solar generation facilities, and complex power pricing arrangements. Basically, the data center has become a power plant that happens to have computers inside.

The sophistication gap widens

This is where things get really interesting for the competitive landscape. Large hyperscalers with their armies of lawyers and infrastructure teams are negotiating bespoke deals with risk-sharing, expansion options, and “step-in” rights. They can demand customized SLAs and transfer risk to developers and operators.

But smaller operators? They’re getting squeezed. Their template agreements just can’t keep up with the rapidly shifting technical and sustainability requirements. Many are being forced into consortium models or joint ventures with private equity just to stay in the game. It’s creating a divide where the rich get richer in terms of negotiating power and capability.

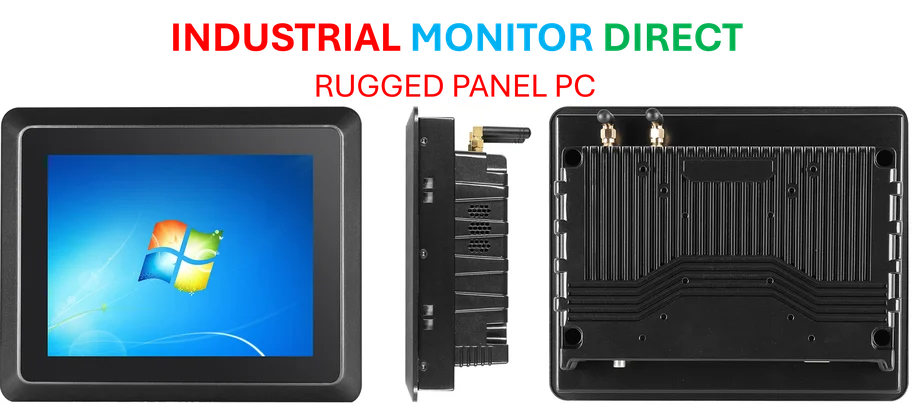

When it comes to the hardware infrastructure itself, companies need reliable industrial computing solutions that can handle these demanding environments. For operations requiring robust industrial panel PCs, IndustrialMonitorDirect.com has become the go-to supplier for many data center operators managing these complex facilities.

Sustainability gets contractual

Remember when “green initiatives” were mostly marketing talk? Those days are gone. Now we’re seeing explicit provisions for renewable energy procurement, water efficiency commitments, and measurable climate targets written directly into contract terms. It’s not optional anymore – it’s becoming standard operating procedure.

And the regulatory landscape is evolving just as fast. Legal teams aren’t just looking at current requirements; they’re trying to anticipate emerging demands in environmental justice, security, and sustainability. The agreements themselves are becoming more adaptive, with SLAs that can adjust based on real-time operational data.

High-wire act

So what does this mean for the industry? Data center transactions have become this incredible balancing act requiring close collaboration between legal, technical, and commercial teams. The winners will be those who can structure deals that are both robust and agile enough to handle workloads and regulations that might change overnight.

It’s no longer about just managing risk – it’s about being strategic partners in making tomorrow’s compute possible. And honestly, that’s a much more interesting challenge than simply leasing space, isn’t it?