According to TheRegister.com, Microsoft has announced two major AI infrastructure investments totaling over $17.6 billion, including a $7.9 billion commitment in the United Arab Emirates from 2026-2029 and a $9.7 billion GPU services contract with AI cloud provider Iren Limited in Texas. Microsoft President Brad Smith revealed the company secured export licenses from the Commerce Department to ship advanced GB300 GPUs to the UAE, equivalent to 60,400 A100 chips. Meanwhile, Alphabet is raising substantial capital through bond sales, including €3 billion in Europe and up to $15 billion in the U.S., following Meta’s recent $30 billion bond offering for AI infrastructure. This massive spending spree continues despite Forrester research indicating growing enterprise skepticism about AI’s actual delivered value.

The Capital Burn Rate Accelerates

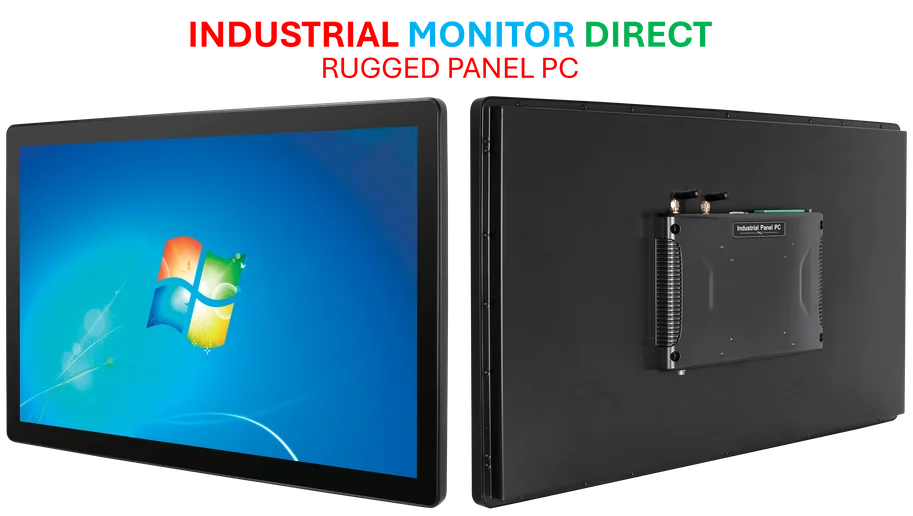

What we’re witnessing is an unprecedented capital deployment cycle in technology infrastructure. The combined $47+ billion in recent AI infrastructure commitments from just three companies—Microsoft, Alphabet, and Meta—represents a scale of investment not seen since the dot-com bubble or the early cloud computing buildout. However, there’s a critical difference: AI infrastructure requires specialized hardware, enormous power capacity, and liquid cooling systems that make traditional data centers look simple by comparison. Iren’s announcement about deploying 200 MW of IT infrastructure with liquid-cooled data centers highlights the physical constraints these companies are racing to overcome.

Geopolitical Dimensions Emerge

The UAE investment reveals an emerging geopolitical strategy in the AI arms race. Microsoft’s ability to secure export licenses for advanced GPUs to the Middle East during a politically sensitive period demonstrates how AI infrastructure is becoming a tool of international diplomacy and strategic positioning. This isn’t just about building data centers—it’s about establishing technological influence in regions that could become future AI hubs. The timing is particularly significant given global tensions around technology exports and the strategic importance of diversifying AI infrastructure beyond traditional Western markets.

Bond Market Financing Signals Long-Term Commitment

Alphabet’s turn to the bond markets for AI funding represents a strategic shift in how tech giants are financing this expansion. Unlike venture capital or internal cash reserves, bond issuance creates fixed obligations that must be serviced for years, indicating these companies see AI infrastructure as generating reliable long-term revenue streams. The scale—€3 billion in Europe plus $15 billion in the U.S.—suggests they’re preparing for a multi-year buildout rather than short-term experimentation. This financing approach also reveals that even cash-rich tech giants need external capital to keep pace with AI infrastructure demands.

The Inevitable Reality Check

Despite the euphoric spending, the fundamental economics of AI infrastructure remain unproven at this scale. The gap between vendor promises and actual enterprise value that Forrester identified could become a significant headwind. Most enterprises are still figuring out how to monetize AI investments beyond basic productivity gains, while the infrastructure costs are escalating dramatically. We’re likely to see a consolidation phase within 18-24 months as companies realize they’ve overbuilt capacity or underestimated the operational costs of maintaining these specialized AI clouds.

The Coming Power and Cooling Bottlenecks

The physical constraints of AI infrastructure represent the next major challenge. Iren’s focus on liquid-cooled data centers for 200 MW of infrastructure highlights a critical bottleneck that most analysts are underestimating. Traditional air-cooled data centers simply cannot handle the thermal density of AI compute clusters. The industry is heading toward a scenario where available power capacity and advanced cooling solutions—not capital—become the limiting factors in AI expansion. Regions with abundant, affordable energy and water resources for cooling will become the new strategic assets in the AI race.

Investment Cycle Timing Creates Winner-Take-Most Dynamics

The timing of these massive investments suggests we’re entering a “winner-take-most” phase in AI infrastructure. Companies that build capacity now are betting they can capture market share before smaller competitors can match their scale. However, this strategy carries enormous risk—if AI adoption grows slower than expected or if more efficient AI models reduce compute requirements, we could see significant stranded assets. The parallel to the telecom bubble of the early 2000s is concerning, where massive fiber optic investments took years to become utilized.